The student loan crisis persists for another year, and it seems Americans are increasingly making sacrifices to pay off their student loans. NPR reports that the homeownership rate has dropped for people aged 24 to 32, and “the Federal Reserve estimated 20% of that decline is attributable to student loan debt.” For the majority of student loan holders, paying off these loans is necessary before they can make other spending decisions.

To better understand the relationship between student loan debt and what Americans give up, we surveyed 808 college graduates with student debt and 214 without debt. Our findings reveal how pervasive student debt is, how people are paying off their loans, and what they give up in the process. Read on as we explore what Americans sacrifice.

Costly Situation

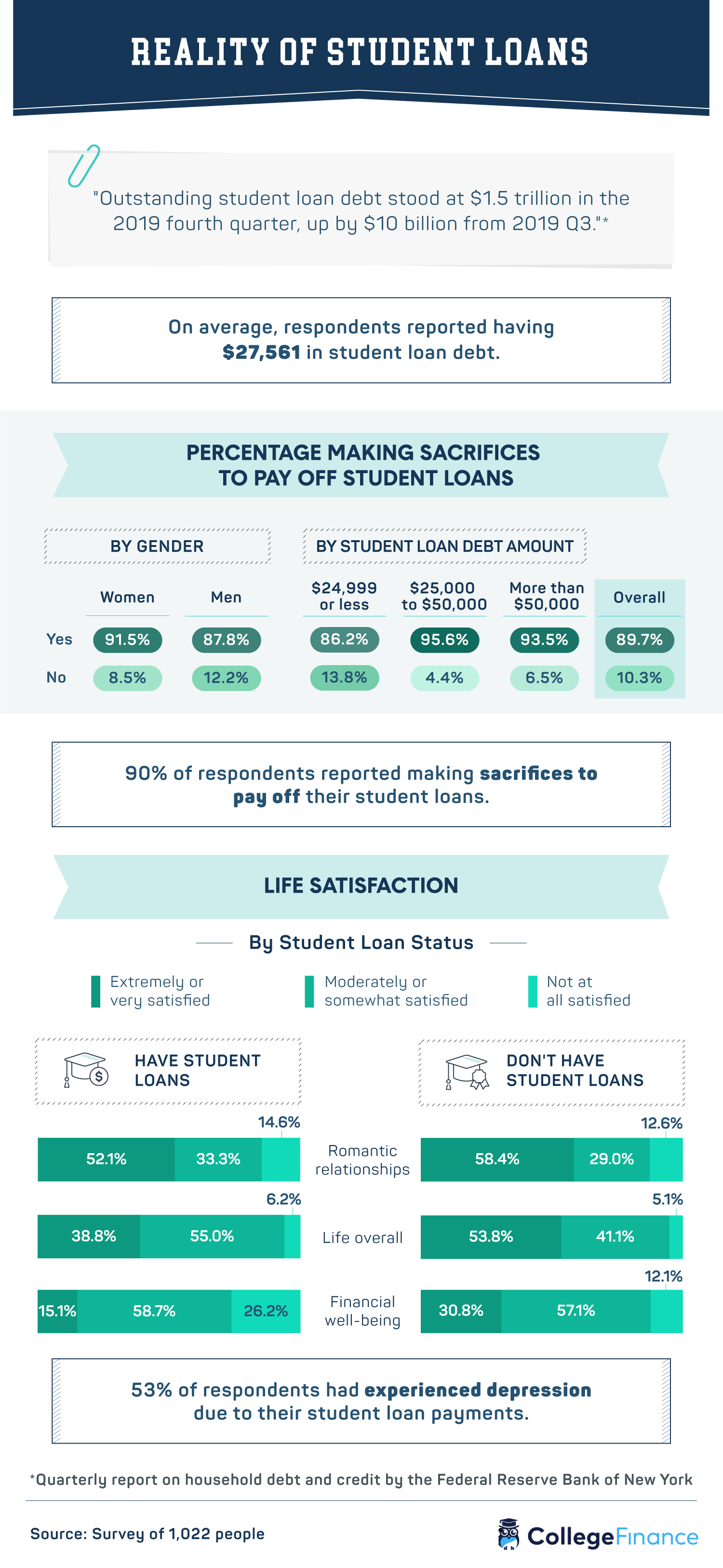

“Outstanding student loan debt stood at $1.5 trillion in the 2019 fourth quarter,” and although experts believe canceling it would give the economy a serious boost, freeing people of their debt burden, more than 44 million Americans owe money for their education.

According to our findings, nearly 9 in 10 people with student loan debt made sacrifices to pay them off. Almost 92% of women reported making sacrifices, compared to 87.8% of men. People who had $25,000 to $50,000 in debt were more likely to make sacrifices than those who had $24,999 or less and more than $50,000.

The majority of Americans have $37,000 in student loan debt, on average, and 53% of people have experienced depression some of the time due to their student loan payments. The reality is that they’re not financially satisfied. Only 15.1% of graduates with debt were extremely or very satisfied with their financial well-being, and people without debt were twice as likely to report being extremely or very satisfied.

Payment Strategy

Unless debtors are in favorable financial standing, it takes time to pay off student loans. Some payment plans give graduates about 10 years to pay off loans, but other plans may provide 30 years to repay the debt. We discovered that respondents employed different payment strategies depending on their financial situation.

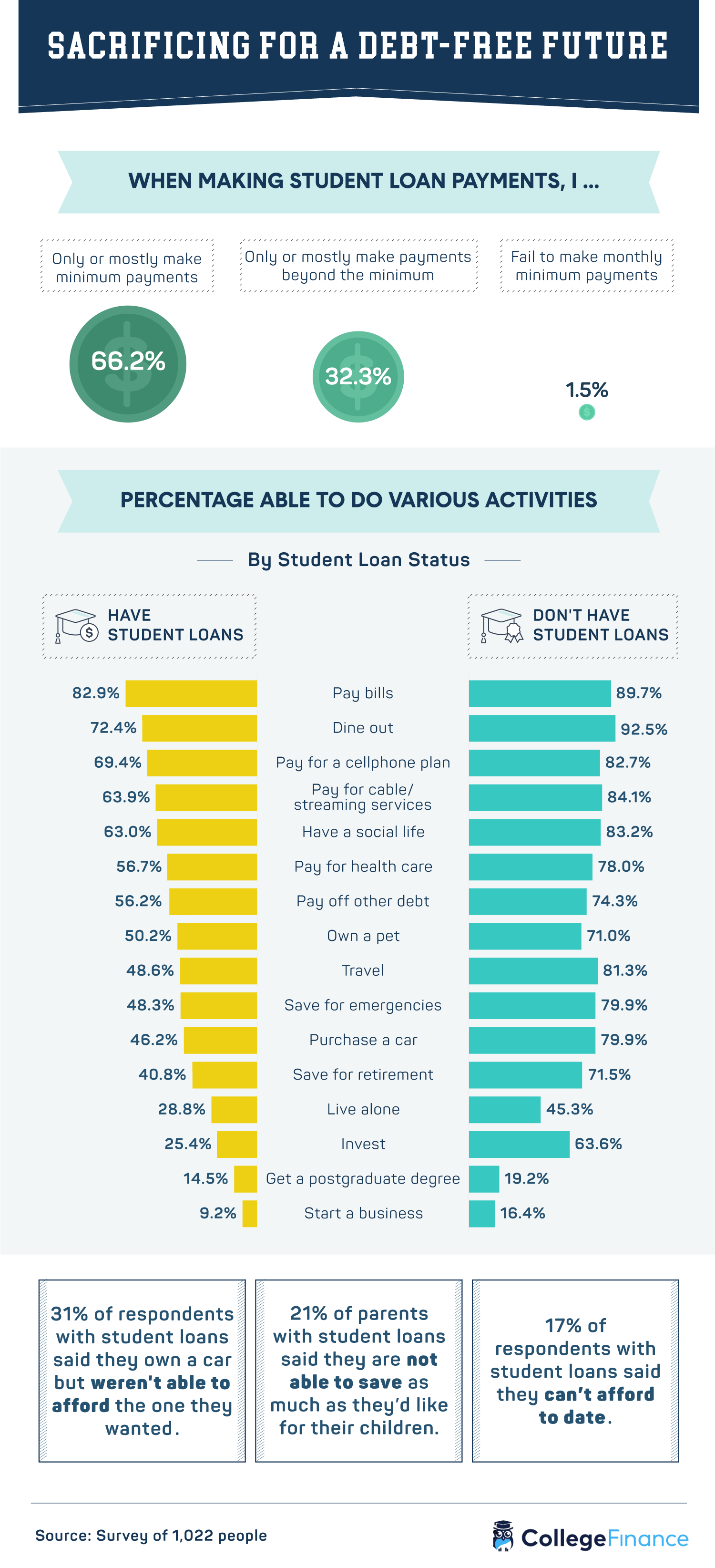

For 66% of graduates in our study, making minimum payments was the go-to plan. But nearly a third of people only or mostly paid more than the minimum amount due each month. Perhaps doing so will allow them to pay off their debt sooner than the standard timeline.

Monthly student loan payments were not all our survey participants struggled to make. Seventeen percent of people with student debt also had trouble paying other bills, and more than half could not invest (74.6%), save for emergencies (51.7%), or enjoy one of life’s most sought-after pleasures: travel (51.4%). Conversely, the majority of those without student debt were able to travel (81.3%), save for emergencies (79.9%), and invest (63.6%).

Making Monthly Payments

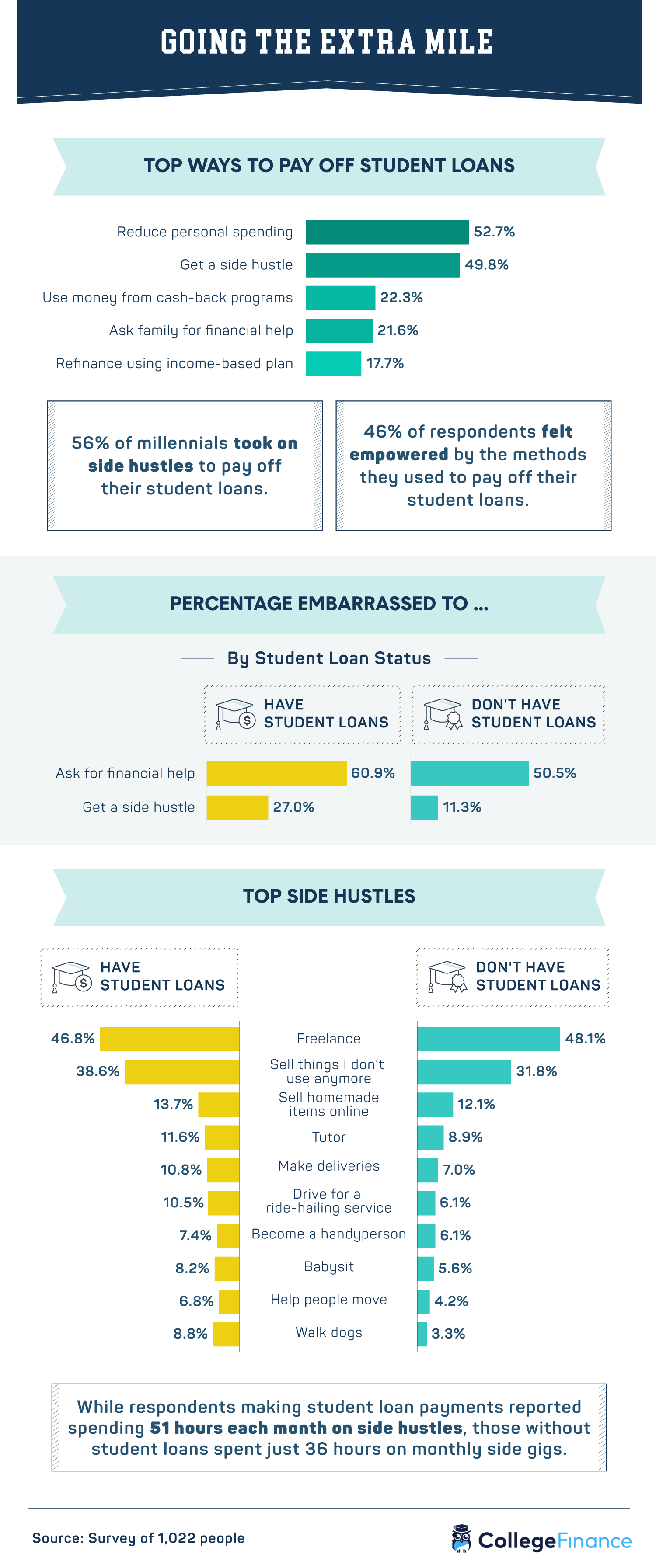

Although a small percentage of Americans reported struggling to make monthly payments, more than 98% of people said they were on time. What sort of payment strategies did they employ? As previously discussed, graduates with student loan debt made sacrifices to meet their monthly obligation. For 52.7% of people, that meant reducing personal spending. Maybe less dining out, delaying getting a pet, that sort of thing.

However, nearly 50% of people with student loan debt joined the gig economy. Recent reports show that millennials and Gen Xers make an average of $10,972 and $8,791 per year, respectively, from side hustles. So, someone with $25,000 in student loan debt stands to be debt-free in about three years.

Those who did not reduce personal spending or get a side hustle relied on one of these three strategies: used money from cash-back programs (22.3%), asked family for financial help (21.6%), and refinanced using an income-based plan (17.7%). But three-fifths of graduates who had student loans shared they were embarrassed to ask for help with finances. While we understand why calling on others for help in times of financial trouble may feel shameful, asking for help is a recommended strategy and may help alleviate the burden.

Paid Off Your Loans?

For those with student loan debt, the reminder comes every month. But talk of the crisis is everywhere: on the political debate stage, at the coffee shop, and on the news. It’s hard to escape. So, what happens when a debtor confirms their last payment? Freedom, right? Not exactly.

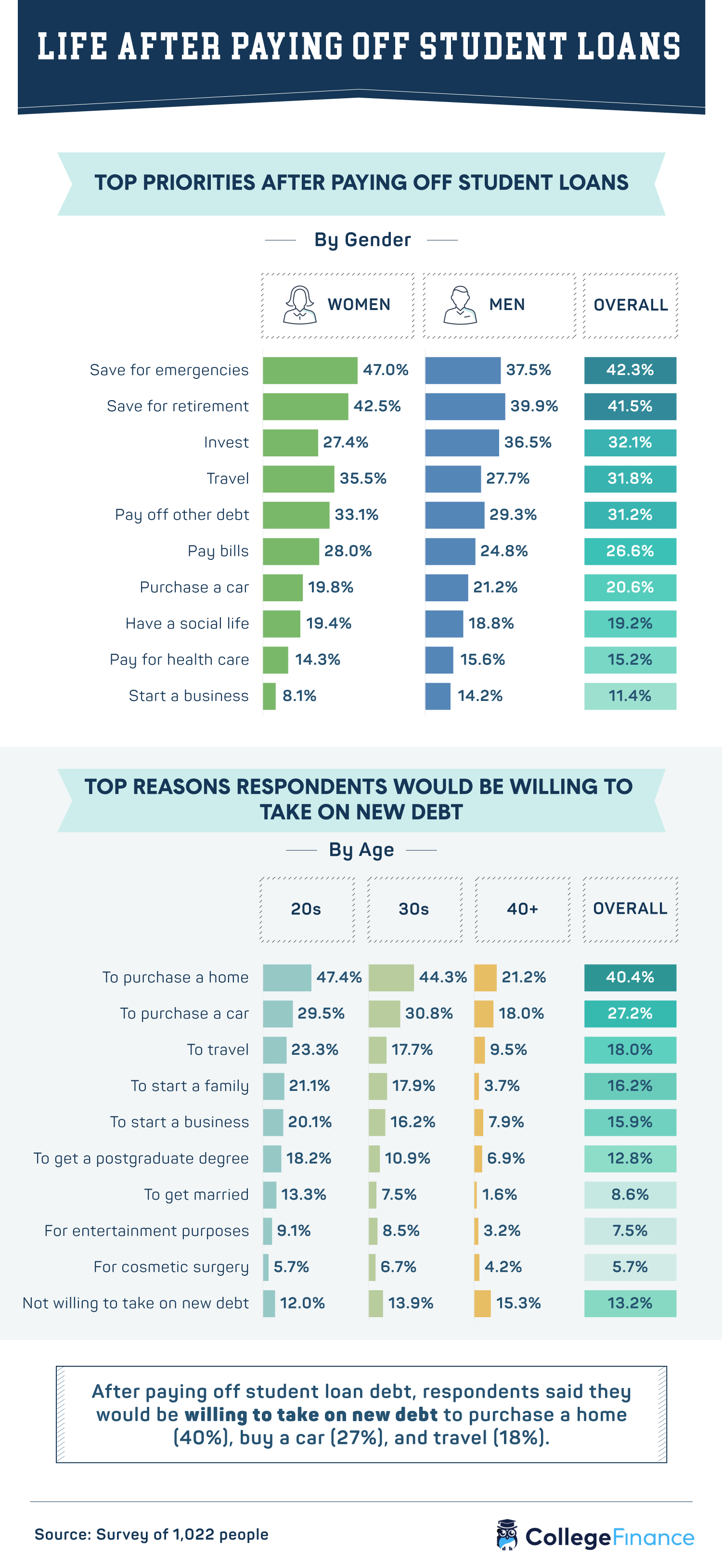

Once student loans are paid off, most people start working toward other financial goals. Saving for emergencies (42.3%) and retirement planning (41.5%) were the top priorities for those in our study. Respondents were also willing to take on new debt. Forty percent reported they’d be willing to go into debt again to purchase a home. This suggests homeownership rates might not have dropped if graduates left higher education without student loan debt.

Freedom From Student Debt

Making student loan payments is something that most Americans commit to for years. But our findings show that once people are free of student debt, they take on other financial responsibilities, such as buying a home or starting a business. Although having debt may be stressful, our findings suggest that most people have financial obligations, but those who feel unprepared may struggle.

We want you to be prepared to take on financial obligations with confidence. Visit CollegeFinance.com and let us help you create a plan. Have questions about which payment strategy you should employ? Or how long you should wait before taking on more debt? We’re here to help.

Methodology

We surveyed 808 college graduates with student loan debt and 214 college graduates without student loan debt. To qualify, respondents had to have at least one of the following: associate, bachelor’s (arts or science), master’s, or Ph.D. Any degree below those was disqualified. For those with student loan debt, they had to currently be paying off student loan debt to qualify. For those without student loan debt, they had to currently be student loan debt-free.

Respondents had to answer questions about their student loans, credit scores, and the sacrifices they’ve made to pay off their student loan debt.

Respondents ranged in age from 23 to 51, with an average age of 32 and a standard deviation of 7. Fifty percent of respondents identified as women, and 50% identified as men. For short, open-ended questions, outliers were removed. To ensure that all respondents took our survey seriously, they were required to identify and correctly answer an attention-check question.

Limitations

These data rely on self-reporting by the respondents and are only exploratory. Issues with self-reported responses include, but aren’t limited to, exaggeration, selective memory, telescoping, attribution, and bias. All values are based on estimation.

Fair Use Statement

Given the breadth of the student loan debt crisis, we’re happy you’re curious about how other Americans are handling their debt. Before you share our research with others, please be sure it is for noncommercial use. We also ask that you link back to this page so that all readers can access the methodology and complete study.